As Chatbots in Banking sector continue to evolve at a great extent, there are many financial institutions around the globe adopting Conversational AI for banking has opened new doors and opportunities for BFSI sector. Ranging from startups to large enterprises, today Chabot’s plays vital role for every business as it is simplifying human to machine interaction.

Most advanced inventions that have gone on to reach significant profitability have been pioneered by banks. When Artificial Intelligence became a realistic option for businesses, it was only a matter of how long before banks turned to AI for better industrial automation to accommodate their customers 'ever-increasing aspirations!

In recent decades, conversational AI in financial services has sparked a lot of attention, with several banks introducing AI-powered conversational alternatives. AI banking bots, whether chatbots or voice bots, can have intelligent and captivating interactions with millions of customers on behalf of the bank at a portion of the expense of hiring traditional customer service representatives. Conversational AI's proactive character, as well as its effectiveness and quality, go a long way toward improving customer experiences.

Individualized banking and customer support have been altered by digital agent assistance and chatbots. “With the introduction of conversational AI Chatbots in banking industry, fast computational constraints, specific client demands, safe data handling and 24*7 accessibility have all been accomplished.” Chatbot in banking improve multidimensional customer engagement while also expanding the reach of the bank.

Let's look at some examples of effective Conversational banking chatbot deployments & chatbot in banking from around the world to gain a better grasp of how it has benefited the different sector.

What Are the Benefits of Investing in Chatbot Services for Banks?

Conversational AI Chatbots are the digitization of banking. Numerous fundamental components of customer care and support, such as quickness, accessibility of information and delightful interactions have become more viable with the introduction of chatbot in banking sector.

A Unique Banking Service

Chatbots in banking industry has provided a unique & customized experience to the users. Customers are increasingly demanding personalized experiences that suits their specific needs & requirements. As per reports, “Personalized experiences and services are expected by 75% of users.” That’s Huge!

Expenses Should Be Kept Minimum

Chatbots in finance, in the digital banking and healthcare industries might save more than 12 billion USD in a year by 2022. According to several estimates, financial organizations might save 2 trillion USD by 2030 by implementing artificial intelligence and cutting costs by 35%.

Improvements In Reducing Risk

Conversational Artificial Intelligence in banking can help regulate and streamline the process of reviewing vital data about perception of service quality' mortgages, market dynamics and the lender's most recent financial movements. As well as issuing credit information and offering risk advice, chatbots help identify fraudsters and optimize processes by reducing human mistakes.

Increase Organizational Productivity & Decrease Work Pressure

Customers will not have to stand in queue for a cashier or sit on the telephone clutching their pearls if an AI Chatbot can manage their questions. Instead of handling common consumer inquiries, employees aided by AI, chatbot for banking also focus on resolving complex issues.

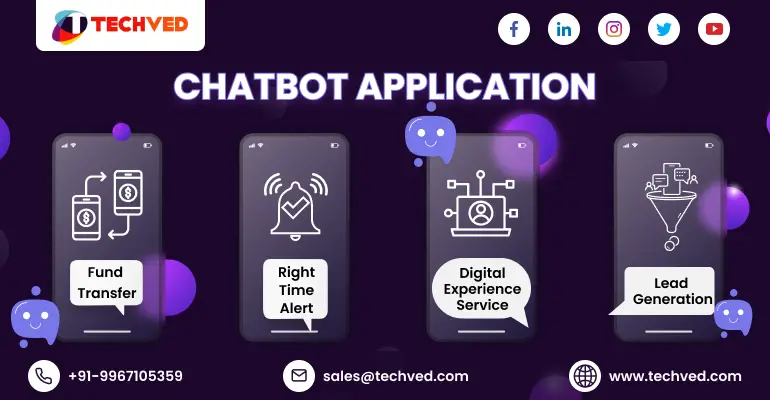

Top 4 Banking-Related Chatbot Application Scenarios

In the digital banking business, banks with Chatbots can automate a variety of functions in addition to enhancing everyday operations and the universal consumer experience.

1. Fund Transfer

Chatbot in banking industry can be used to pay bills, track funds transfer and schedule or reschedule transactions. Chatbots can also be used to debit prepaid cards or pay off credit card balances.

2. Notifications & Alerts at the Right Time

Chatbots technology in banking can provide important notifications and warnings on a routine basis, such as bill payment schedules or the delivery of particular investment activity paperwork. They can also provide vital alerts, such as financial improvements and upgrades in credit scores.

3. Get help from a Customer Service Representative

Chatbots in financial services enhance performance by automating service experience. In banking bots promote the customer experience by minimizing connection speeds and enabling customers to get answers to specific questions as quickly as possible.

4. Simple Lead Generation

The use of Chatbots in banking industry has revolutionized the overall marketing strategy. Chatbots are installed on the bank's official website/app and interact with customers to see if they really are interested in owning products from the bank.

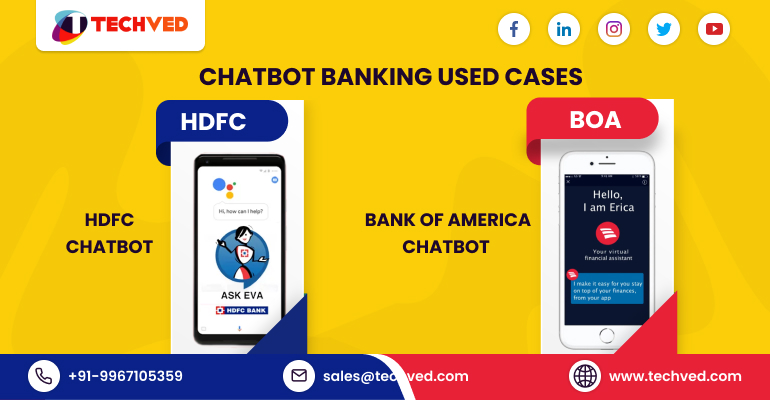

Testimonials of Banking Chatbots from all over the Globe

Here are few banking chatbot examples of some of the biggest brands that implemented chatbots in banking sector.

Bank of America's Erica

Erica, a virtual financial adviser powered by AI, was introduced by Bank of America, a leader in the US banking business. This Bank of America Chatbot met the bank's service quality needs in a variety of ways, including sending clients reminders, delivering balance information, giving money-saving ideas, updating customers' credit reports, simplifying bill payments and assisting consumers with secure transactions. Bank of America Chatbot Erica's skills have subsequently been improved in order to assist clients in making more informed financial decisions by offering customized and preventative recommendations.

HDFC Bank's EVA

EVA (Electronic Virtual Assistant) is an AI-powered banking Chatbot created by HDFC Bank to offer a better quality of service to HDFC clients. HDFC Chatbot EVA interprets customer inquiries and retrieves the necessary information from thousands of available sources in milliseconds, thanks to the power of Natural Language Processing. The HDFC Chatbot helped with many features like getting information about branch locations, IFSC codes, loan and borrowing costs, and so on. There are just a few of the usual customer requests that EVA handles.

“Chatbot for banking & digitization are all here to remain, even without them, banks would be unable to operate. The best approach is to take the initiative right now. To save every day hours that can be focused on more profitable duties, contact a trustworthy financial software development firm.

FAQS On Banking Chatbot:

Which banks use Chatbots in India?

Chatbots are the future of customer service. Banks that have a huge customer base are embracing chatbots as a smart, self-service, 24/7 customer service channel that can handle a large number of customer inquiries and evolving banking needs of customers without placing too much pressure on their customer service agents. Chatbots are fast, easy-to-use, and address multiple customers at a time. There are many top banks that are using Chatbots like HDFC, ICICI, SBI and so on to streamline their customer experience. Chatbots are an excellent way for banks to improve their customer interactions and experience. They want their customers to be able to interact with them anytime and anywhere they want.

Why Chatbots make the best personal banker?

As the banking industry has been moving towards digital adoption in recent years, it's no surprise that Chatbots have become a major part of the customer experience. Today, everything is getting digitized, whether small or big companies or any financial institutions. Chatbots enhance customer journey and experience at all stages, and banks are already way ahead of the curve when it comes to adopting Conversational AI solutions.

Banks have benefited greatly from consumer engagement at every stage of the customer life cycle thanks to AI-powered chatbots and voice bots. Eventually, these technologies will evolve to the point where they can communicate with customers more naturally. Cost-savings benefits and a more authentic consumer experience will result from this. As a result, banking will become more personalized & virtual in the future than it is today.

What are the financial benefits of Chatbots?

1.Improved customer experience: Chatbots effectively manage financial services and allow them to provide consumers with faster and tailored responses.

2.Automation of tasks: To improve customer experience, financial firms are adopting Chatbots to automate most of their duties, such as resolving customer complaints, answering questions, providing investment advice, and so on.

3.Simplified on-boarding process: Chatbots are frequently employed in the financial industry for on-boarding purposes, allowing consumers to set up a new account without having to go through the usual steps at the branch.

4.Support cost reduction: Financial Chatbots can help firms cut customer care expenses by up to 30%, which is why the financial industry can utilize them to resolve issues quickly.

5.Increased revenue: Companies that have integrated financial services Chatbots into their processes are able to win new consumers as a result of quick support and excellent services, which helps them increase revenue

Why do banks need Chatbots?

As the banking sector continues to evolve, technology is expected to play a significant role in increasing customer engagement. Chatbots are one way that banks can reduce costs while improving customer engagement levels. The increased use of Chatbots will help banks increase revenue generation opportunities by allowing them to target specific customers with personalized content and services, thereby reducing customer churn and increasing customer lifetime value. Chatbots are a huge boon for the banking industry, helping streamline transactions like money transfers and account balance checks via a conversational interface so that customers are constantly guided through their actions.

How Chatbots are redefining the banking experience?

Chatbots are transforming banking by automating all processes. Chatbots, as conversational AI, are capable of performing a wide range of customer support duties, freeing up the time of human agents. Banking chatbots also help to automate monotonous tasks. All of this results in significant enhancements to the banking experience.

- Chatbots help customers manage their finances

- Chatbots reduce financial fraud and improve security

- Chatbots increase digital customer engagement with banks

- Chatbots reduce costs by simplifying processes

- Chatbots increase customer satisfaction through improved ease of use and intuitive design

- Chatbot-based offerings help banks reach new customers

- Chatbot-based offerings help banks compete against fintech startups that can provide similar services at lower prices

How companies can leverage Chatbots in financial services?

Financial services are moving towards a conversational AI era, which is why Chatbots have become the new normal in the delivery of financial services. Customers can now expect to see a variety of services delivered through a single platform, without having to visit an office or wait in a long line. Customers can now accept simple access to services that were previously exclusive to apps because of chatbots' conversational AI and multi-channel capabilities.

Financial firms will require more Chatbots to provide outstanding client experiences and keep up with new-age demand. This is why the BFSI sector must discover ways to incorporate financial services Chatbots into their procedures in order to achieve a new level of client service!

Conclusion:

Chatbots are here to stay for the foreseeable future. Chatbots are an incredibly useful tool for any business because they allow your customers to interact with your brand in an automated way that feels more natural than a phone call or email could ever be. They are changing the way businesses communicate and understand their customers.

Chatbots with AI can provide a more personalized customer experience. It enhances and uplifts businesses’ customer services, internal operations, and marketing. Chatbots have enormous potential for integration with a company's website, app, and social media platforms. Ecommerce & BFSI are the industries that are already using Chatbot capabilities, and there are chances for brands to begin leveraging all of the ways Chatbots may help brands expand.

The latest innovations in artificial intelligence are making it possible to create Chatbots that can carry on a conversation with humans, even when they aren’t under direct human control. This means that they will be able to respond to your questions and requests in increasingly lifelike ways. They will become more secure, capable and versatile over time as they gain more features and capabilities. Whether you need customer service or need help behind the scenes, the AI Chatbots of the future will be accessible and trustworthy communication tools.